ABOUT US

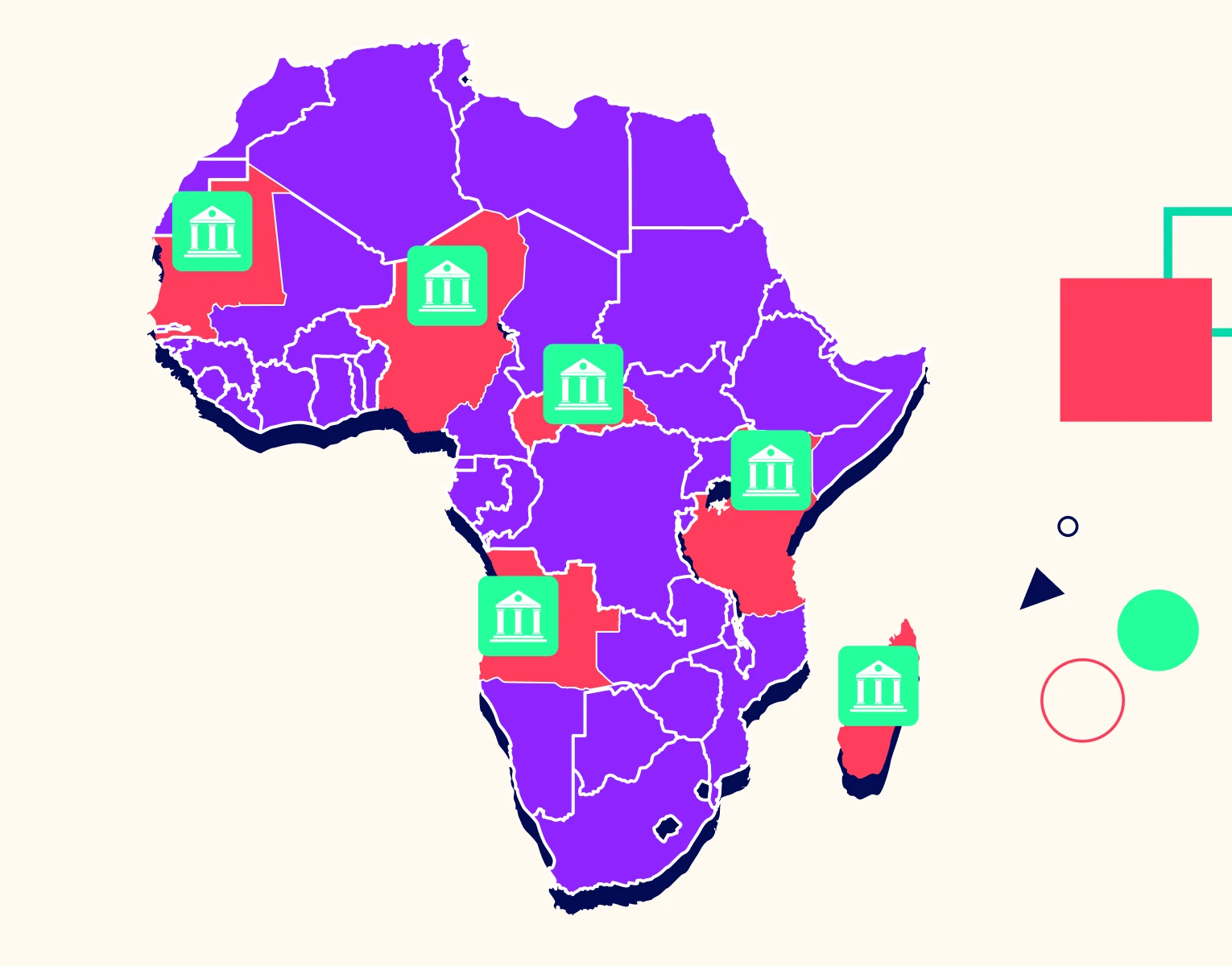

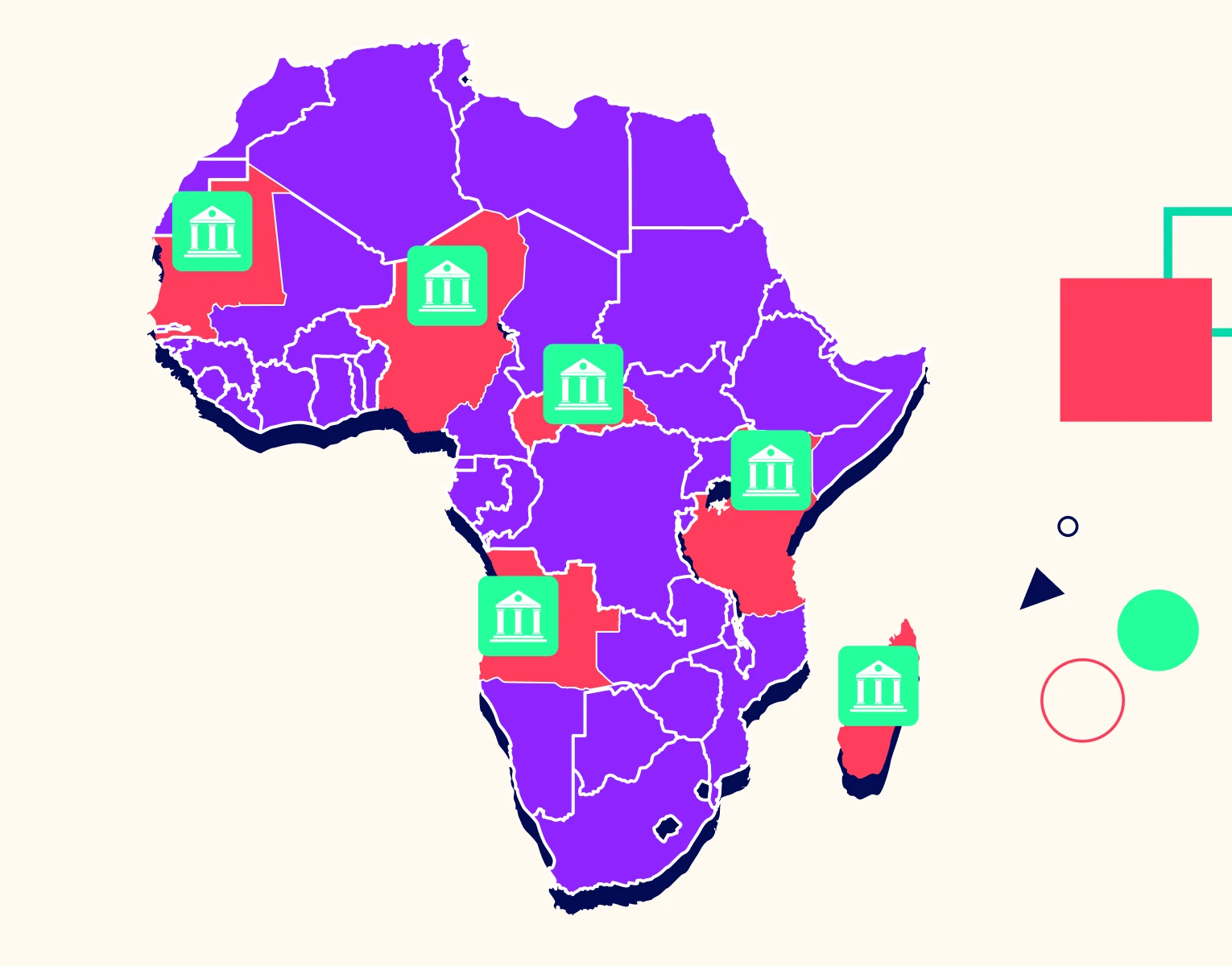

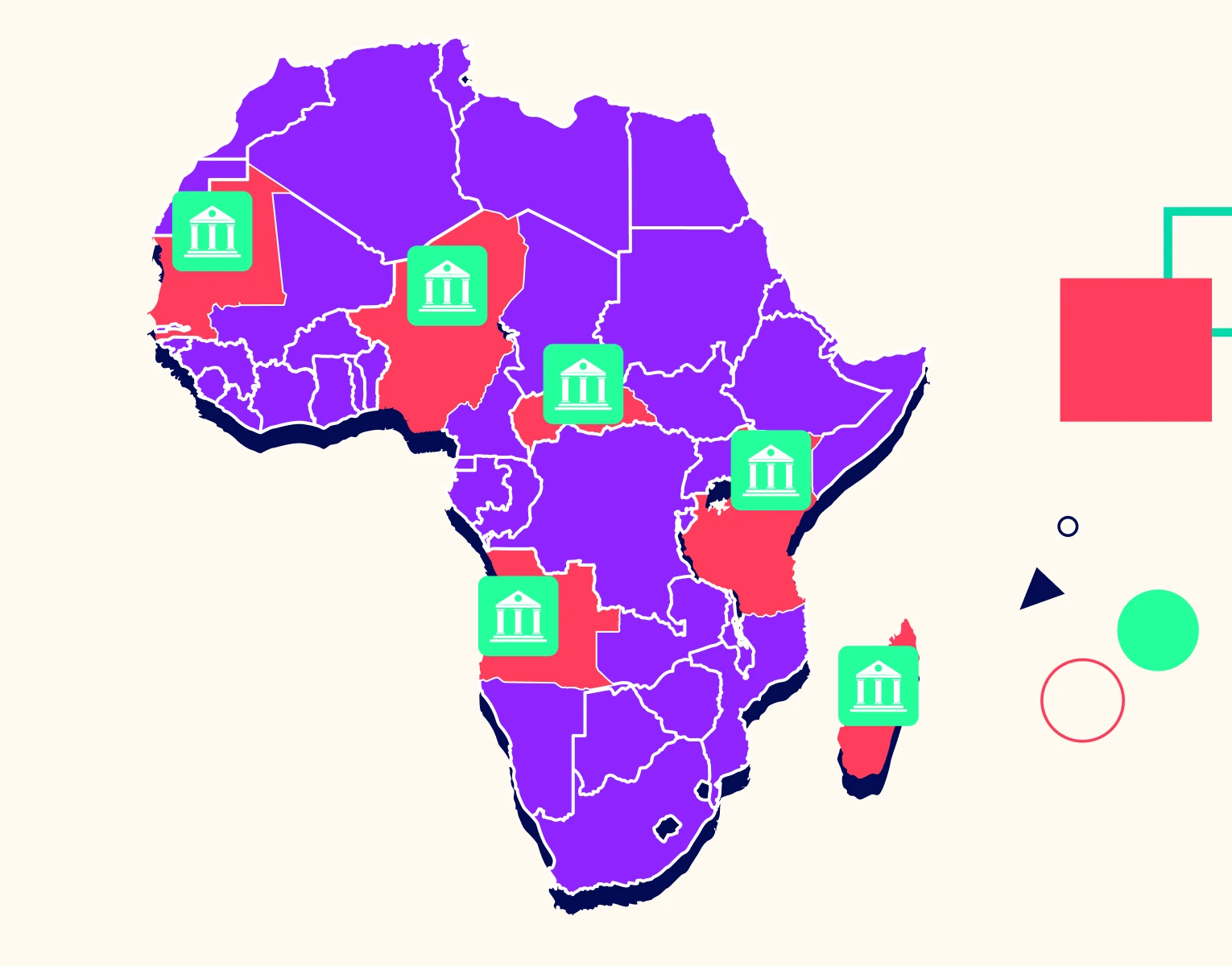

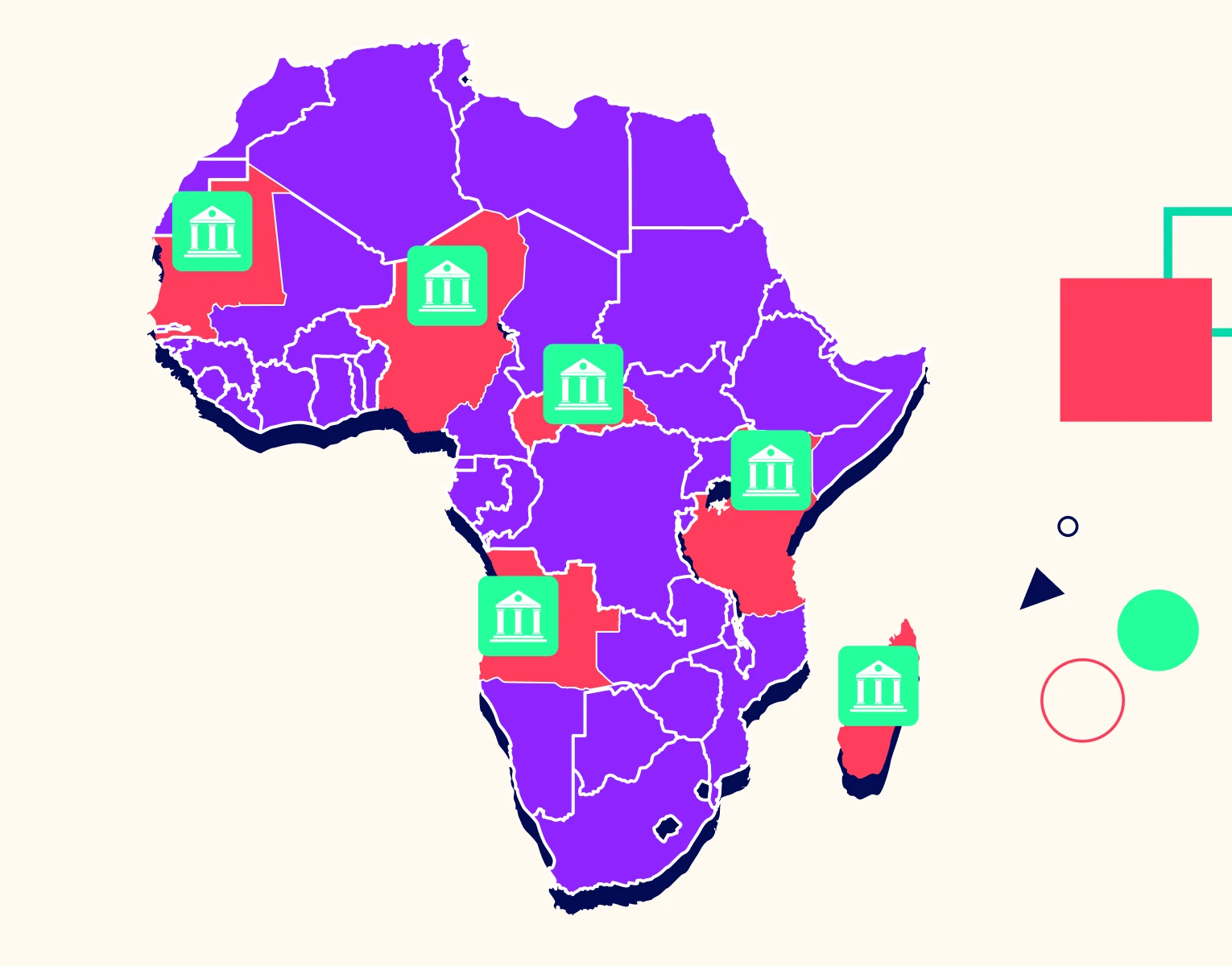

Robust Financial Education Platform For Africa

Robust Financial Education Platform For Africa

Robust Financial Education Platform For Africa

Genzaar is a platform that utilizes various media such as games, cartoons, comics and merchandise to provide financial education and practical skills training for everyone. Our vision is to extend financial education and inclusion to underserved groups across Africa.

Genzaar is a platform that utilizes various media such as games, cartoons, comics and merchandise to provide financial education and practical skills training for everyone. Our vision is to extend financial education and inclusion to underserved groups across Africa.

Genzaar is a platform that utilizes various media such as games, cartoons, comics and merchandise to provide financial education and practical skills training for everyone. Our vision is to extend financial education and inclusion to underserved groups across Africa.

Our Mission

Our Mission

Our Mission

At Genzaar, we're on a mission to provide individuals of all ages and backgrounds with the financial knowledge and skills they need to make smart financial decisions. We believe everyone deserves a chance to live a successful life. That is why our ultimate goal is to help you avoid the pitfalls of poverty and prepare you for a secure future.

At Genzaar, we're on a mission to provide individuals of all ages and backgrounds with the financial knowledge and skills they need to make smart financial decisions. We believe everyone deserves a chance to live a successful life. That is why our ultimate goal is to help you avoid the pitfalls of poverty and prepare you for a secure future.

Our Mission

At Genzaar, we're on a mission to provide individuals of all ages and backgrounds with the financial knowledge and skills they need to make smart financial decisions. We believe everyone deserves a chance to live a successful life. That is why our ultimate goal is to help you avoid the pitfalls of poverty and prepare you for a secure future.

Identifying the Gap

Identifying the Gap

Identifying the Gap

Financial education is often overlooked in solving the poverty gap. The United Nations predicts that by 2030, if the current trend persists, 7% of the world’s population–about 575 million people, will still be living in extreme poverty and an estimated 300 million children and young people will still lack basic numeracy and literacy skills.

Identifying the Gap

Financial education is often overlooked in solving the poverty gap. The United Nations predicts that by 2030, if the current trend persists, 7% of the world’s population–about 575 million people, will still be living in extreme poverty and an estimated 300 million children and young people will still lack basic numeracy and literacy skills.

Where We Come In

Where We Come In

Where We Come In

Our idea came from this simple belief – everyone should have access to Financial Education. For us it is more than just an idea, it is a commitment that strongly aligns with the Sustainable Development Goals of No Poverty and Quality Education.

We believe that everyone, no matter how old they are or where they come from, should have access to the tools needed to learn about money.

Our mission is simple – to give everyone the tools they need to make smart choices about their money and build the future they want.

Where We Come In

Our idea came from this simple belief – everyone should have access to Financial Education. For us it is more than just an idea, it is a commitment that strongly aligns with the Sustainable Development Goals of No Poverty and Quality Education.

We believe that everyone, no matter how old they are or where they come from, should have access to the tools needed to learn about money.

Our mission is simple – to give everyone the tools they need to make smart choices about their money and build the future they want.

“

“

Sub-Saharan Africa faces the biggest challenges in providing schools with basic resources. The situation is extreme at the primary and lower secondary levels, where less than one-half of schools in sub-Saharan Africa have access to drinking water, electricity, computers and the Internet. Inequalities will also worsen unless the digital divide – the gap between under-connected and highly digitalized countries – is not addressed.

Sub-Saharan Africa faces the biggest challenges in providing schools with basic resources. The situation is extreme at the primary and lower secondary levels, where less than one-half of schools in sub-Saharan Africa have access to drinking water, electricity, computers and the Internet. Inequalities will also worsen unless the digital divide – the gap between under-connected and highly digitalized countries – is not addressed.

United Nations

United Nations

What Drives Us

At Genzaar, our values aren't just words, they're the heartbeat of our mission. They shape the way we work together and influence every aspect of what we do.

Transparency

We believe in clarity and openness, ensuring that our users and partners can rely on us for a genuine and authentic experience.

Empathy

Understanding and support are a big part of our culture. We connect deeply with the challenges you face on your financial journey.

Accountability

We take our responsibilities seriously and are dedicated to being accountable to our users, partners, and community. We strive to foster trust through open communication and honest practices.

Collaboration

We believe in working together, forging partnerships, and uniting efforts to make financial education universally accessible.

Harmony

We work together seamlessly to achieve common goals. We create a harmonious environment that encourages unity among our team, partners, and users. Our goal in embracing diversity and inclusivity is to provide a good and balanced contribution to financial education.

Our Team

Our Team

We are a team of passionate and dedicated individuals who are committed to making a positive impact on the lives of people across the globe. With a mix of innovation, expertise, and dedication, we came together to create Genzaar.

Our Team

We are a team of passionate and dedicated individuals who are committed to making a positive impact on the lives of people across the globe. With a mix of innovation, expertise, and dedication, we came together to create Genzaar.

Download on App store

COMING SOON

App Store

Download on Playstore

COMING SOON

Google play

Download on App store

COMING SOON

App Store

Download on Playstore

COMING SOON

Google play

Download on App store

COMING SOON

App Store

Download on Playstore

COMING SOON

Google play

Download on App store

COMING SOON

App Store

Download on Playstore

COMING SOON

Google play

Our core values we return to when we make decisions.

Our core values we return to when we make decisions.

Transparency

We believe in clarity and openness, ensuring that our users and partners can rely on us for a genuine and authentic experience.

Empathy

Understanding and support are a big part of our culture. We connect deeply with the challenges you face on your financial journey.

Accountability

We take our responsibilities seriously and are dedicated to being accountable to our users, partners, and community. We strive to foster trust through open communication and honest practices.

Collaboration

We believe in working together, forging partnerships, and uniting efforts to make financial education universally accessible.

Harmony

We work together seamlessly to achieve common goals. We create a harmonious environment that encourages unity among our team, partners, and users. Our goal in embracing diversity and inclusivity is to provide a good and balanced contribution to financial education.

Financial Education and Inclusion For All

Suite

Company

Copyright © 2024 Genzaar. All Rights Reserved

Financial Education and Inclusion For All

Suite

Company

Copyright © 2024 Genzaar. All Rights Reserved

Financial Education and Inclusion For All

Suite

Company

Copyright © 2024 Genzaar. All Rights Reserved

Financial Education and Inclusion For All

Suite

Company

Copyright © 2024 Genzaar. All Rights Reserved